Having to file an SR-22 is no one's suggestion of fun. You'll pay higher vehicle insurance premiums than a vehicle driver with a tidy record and also you'll be restricted in your option of insurance companies. But going shopping around for the most inexpensive prices can assist. Here's what you need to recognize - sr22 coverage. See what you can minimize auto insurance, Conveniently compare tailored rates to see just how much changing cars and truck insurance coverage can save you.

You might be needed to have an SR-22 if: You have actually been founded guilty of DUI, Drunk driving or one more major relocating offense. You've caused a mishap while driving without insurance.

Not all states require an SR-22 or FR-44. If you need one, you'll locate out from your state division of electric motor cars or website traffic court.

When you're alerted you require an SR-22, begin by contacting your vehicle insurance provider. Some insurance providers do not use this solution, so you may require to buy a company that does. If you do not already have automobile insurance coverage, you'll probably require to buy a policy so as to get your driving advantages recovered - insure.

Insurance quotes will also vary depending on what automobile insurance coverage firm you select. See what you could save on cars and truck insurance policy, Quickly contrast tailored rates to see how much changing vehicle insurance policy could save you.

Sr-22: What You Need To Know - Freeway Insurance Things To Know Before You Get This

Location matters. As an instance, think about a driver with a recent DUI, an offense that might result in an SR-22 demand. Nerd, Budget's 2021 price evaluation located that out of the country's four largest business that all file View website an SR-22, insurance coverage rates generally were most affordable from Progressive for 40-year-old chauffeurs with a current drunk driving.

When your need ends, the SR-22 does not instantly fall off your insurance coverage policy. Make sure to allow your insurance company understand you no longer require it (vehicle insurance).

Rates usually stay high for 3 to five years after you have actually triggered an accident or had a moving offense. If you look around after the 3- and five-year marks, you may locate lower costs (insure).

Which states require SR-22s? Each state has its own SR-22 protection demands for motorists, and all undergo change (no-fault insurance). Obtain in touch with your insurance policy service provider to learn your state's existing demands and make sure you have appropriate insurance coverage. How long do you require an SR-22? Most states require chauffeurs to have an SR-22to prove they have insurancefor about 3 years.

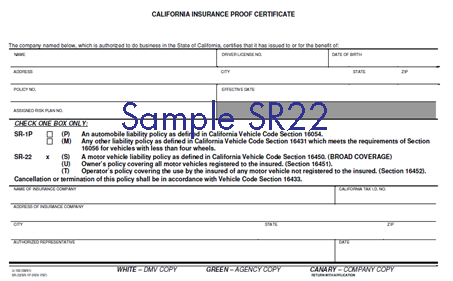

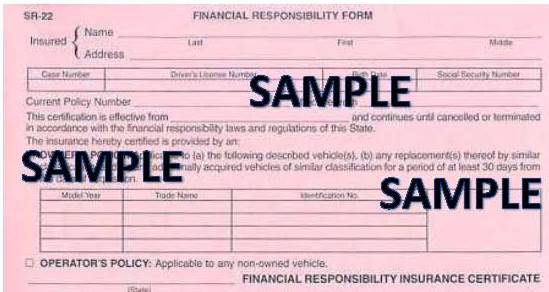

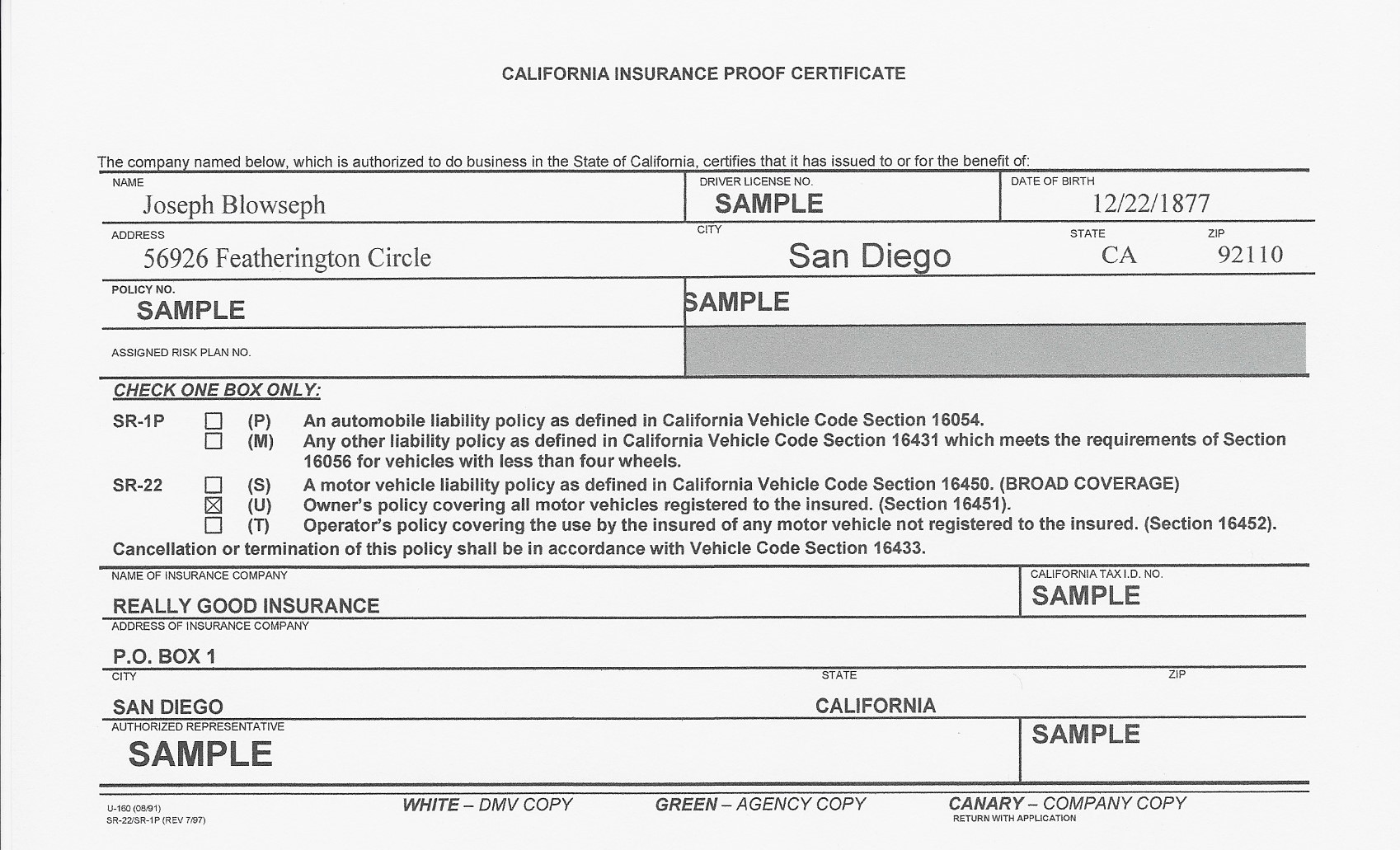

What is an SR-22? An SR-22 is a certification of economic obligation needed for some chauffeurs by their state or court order. An SR-22 is not an actual "type" of insurance coverage, yet a type filed with your state. This form works as evidence your vehicle insurance plan meets the minimal responsibility coverage required by state legislation.

Little Known Questions About What Does Sr22 Mean In Car Insurance? - Answer Financial.

insurance sr22 dui bureau of motor vehicles bureau of motor vehicles

insurance sr22 dui bureau of motor vehicles bureau of motor vehicles

Do I need an SR-22/ FR-44? Not everybody requires an SR-22/ FR-44. Laws vary from one state to another. Usually, it is called for by the court or mandated by the state only for sure driving-related offenses. : DUI convictions Reckless driving Mishaps created by uninsured chauffeurs If you require an SR-22/ FR-44, the courts or your state Motor Car Division will certainly notify you.

Is there a fee connected with an SR-22/ FR-44? This is a single charge you should pay when we file the SR-22/ FR-44.

A filing charge is billed for every individual SR-22/ FR-44 we submit - coverage. If your partner is on your plan as well as both of you need an SR-22/ FR-44, after that the filing charge will certainly be charged two times. Please note: The charge is not consisted of in the price quote because the declaring fee can vary.

For how long is the SR-22/ FR-44 legitimate? Your SR-22/ FR-44 must be valid as long as your insurance policy is active. If your insurance policy is canceled while you're still required to lug an SR-22/ FR-44, we are required to notify the appropriate state authorities. If you do not maintain continuous coverage you can lose your driving advantages.

Don't stress, we obtained this. Easy declaring. Got a letter from the State of Illinois to confirm your insurance coverage?

The 9-Second Trick For Sr22 Insurance: What Is An Sr-22 And How Does It Work?

Instant SR-22 Insurance Coverage Filing If your license has been suspended, revoked, or you've had a DRUNK DRIVING, a might be needed to renew your driving opportunities. With Insure instantly, you can online submit today!.? (ignition interlock).!! We'll take care of it for you as well as conserve you cash. or Call ( 773) 202-5060 Need SR22? We Make It Easy! You have concerns.

SR-22 insurance!.?.!? To get a Chicago SR-22 insurance policy certification, you need a vehicle insurance coverage policy that meets the state's minimum liability insurance coverage. When you obtain a policy with Insure right away, a record is submitted to the state confirming that you have protection. If your license has actually been put on hold, withdrawed, or you are deemed a high danger diver.

Responsible Mishaps, Depending on the intensity of a mishap, if you have been discovered responsible for a crash, you might additionally be purchased by the courts to preserve an SR-22 for a collection amount of time. Multiple Offenses, Those that acquire multiple smaller sized website traffic infractions in a brief amount of time may need to file an SR22.

Just How Does SR-22 Insurance coverage work? If a chauffeur requires to file an SR-22, they will receive a court order notifying them of their demands. It is the chauffeur's responsibility to consider that details to their state's Department of Electric motor Vehicles (DMV) or Bureau of Motor Autos (BMV). You may have problems if your company is not accredited in the state requesting an SR-22 certification.

Living in a different state does not mean your SR-22 demands disappear. If your insurance policy business is not accredited in the state asking for the SR-22, you will certainly need to directly send the SR-22 kind with that state's DMV.If the procedure is overwhelming, contact the state's Division of Electric motor Vehicles or your representative for aid on your state's demands.

Our Sr-22 Car / Auto Insurance Quotes In Arizona & Indiana Ideas

SR22 Insurance Prices, Just how much an SR-22 filing expenses differs by state. Motorist's typically pay around a $25 filing fee for filing SR-22 insurance policy. This can vary by state and the insurance supplier. An SR-22 is relatively cheap and obtains connected to your preexisting policy. driver's license. If you are dropped from your service provider or never ever had cars and truck insurance, you have some options to make when it pertains to locating the very best coverage rates.

Satisfying your state's needs must be a top priority, yet you wish to discover a quote with a policy that is economical. With virtually every firm providing a quote online, your opportunities of discovering great protection at an also better rate might enhance. Will an SR-22 plan influence my insurance expense? Yes.

Always be gotten ready for greater insurance coverage prices after the filing. Just How to Lower Vehicle Insurance Policy Rates After an SR-22 plan, Your automobile insurance policy premiums are bound to increase following an SR-22 requirement and also you're mosting likely to intend to find a way to lower them. While they might never be as low as they were pre-SR-22, there are still some methods to make them match your spending plan better (auto insurance).

division of motor vehicles insurance companies dui sr22 coverage insurance group

division of motor vehicles insurance companies dui sr22 coverage insurance group

auto insurance underinsured division of motor vehicles ignition interlock sr22 insurance

auto insurance underinsured division of motor vehicles ignition interlock sr22 insurance

Your insurance deductible is just how much you assure to pay in case of a claim. The higher your deductible is, the less your insurance policy costs will certainly be. When you accept pay even more out of pocket, your insurer will certainly need to pay out less following a case. It is crucial to keep in mind that as soon as you establish your deductibles at a particular amount, you need to see to it that you can really pay it adhering to an accident.

High-powered, luxury cars are more costly to insure than your day-to-day car. More recent designs also have a tendency to be much more costly to cover than decades-old vehicles. It's advantageous to look around and sell your vehicle for one that's a pair of years of ages with great safety and security scores. You will seem much less of an insurability danger to your insurance policy supplier.

The Basic Principles Of Sr-22 For Revocations/suspensions

If you are still displeased with your insurance premiums, ask your insurance representative concerning any kind of discount rates you are qualified for - insure. Representatives are well informed of the fundamentals of all type of discount rates you can get. Terminating or Eliminating Your SR-22 Protection, Even if you are specific your SR-22 period is up, contacting your states Division of Motor Autos or DMV verifying that is an excellent suggestion.

Carrying just the state minimum protection will commonly not suffice when you need an FR-44. This, subsequently, will certainly increase your cars and truck insurance policy prices. An FR-44 certification is required for 3 years on average, and it likewise can not be terminated prior to the expiry date. SR-22 Frequently Asked Inquiries, Are there various kinds of SR-22s? There are 3 choices when acquiring an SR-22 certification from your insurance company, Proprietor, Driver, and Owner-Operator (insurance).

Driver - An Operator's SR22 Kind is for drivers that borrow or rent out an automobile as opposed to owning one - bureau of motor vehicles. This may also be coupled with non-owner SR-22 insurance coverage and can offer a less expensive choice if it's tough covering the cost of an SR-22. Operator-Owner - The Operator-Owner's SR22 Type is meant for drivers that both own an auto but periodically, rent or obtain one more cars and truck.

auto insurance insurance dui insurance deductibles

auto insurance insurance dui insurance deductibles

You likewise can not just buy an SR-22 certificate. It goes hand-in-hand with your automobile insurance coverage plan. Just How Can I Discover The Least Expensive SR22 Insurance Coverage Near Me? The very best means to find cheap SR22 insurance policy near you is by looking around as well as obtaining quotes. This is important when you are obtaining any type of insurance coverage plan but specifically crucial for SR22s - sr-22.

National insurance firms are not anxious to supply coverage for someone who requires SR22 insurance coverage. You may have far better good luck with regional firms as they commonly will cover high-risk chauffeurs, which you will be taken into consideration with your SR22 need. Be sure to get SR22 quotes from every insurance provider you discover and assess all the SR22 policies available on the market. liability insurance.

Not known Facts About Mandatory Insurance Faqs - Missouri Department Of Revenue

Does SR-22 Insurance Cover Any Type Of Automobile I Drive? Yes, your SR22 insurance coverage will certainly cover any type of vehicle you drive as long as you have owner-operator SR22 insurance policy - division of motor vehicles. An owner-operator SR22 certification is a kind of SR22 type that allows you to drive any type of lorry, despite who has it, as well as still be identified as an insured vehicle driver with a valid SR22.

underinsured driver's license driver's license insurance group driver's license

underinsured driver's license driver's license insurance group driver's license

Proprietor SR22 insurance is an SR22 type that only enables you to drive lorries that you have. Non-owner SR22 insurance is the least expensive alternative yet is only for individuals that do not have a vehicle yet they often drive, whether it be from leasing or obtaining somebody else's car. It depends on what your vehicle possession status is when it pertains to whether your SR22 will certainly rollover to cars you drive.